sponsor content What's this?

Securing Air Dominance: Strategic Fighter Development in the Indo-Pacific

Presented by

Forecast International

The Asia-Pacific region stands as one of the world's most dynamic defense markets. Spanning two continents and two oceans, the area encompassing East and South Asia and Oceania includes advanced and fast-growing economies, vital maritime trade routes, and persistent geopolitical flashpoints. Chief among these is China's ongoing military modernization, which is driving increased defense investment across the region.

A major priority for regional militaries is securing a qualitative edge in the aerospace domain. From combat aircraft and airborne early warning systems to intelligence, surveillance, and reconnaissance platforms and air defense systems, nations are focused on protecting their airspace and critical infrastructure while denying adversaries control of the skies.

This strategic push has led to a surge in indigenous combat aircraft programs, with countries striving to develop advanced fighters, grow local industry, and showcase their technological ambitions.

The following shines a spotlight on several Asia-Pacific countries, their current fighter capacity, and their respective future combat air programs.

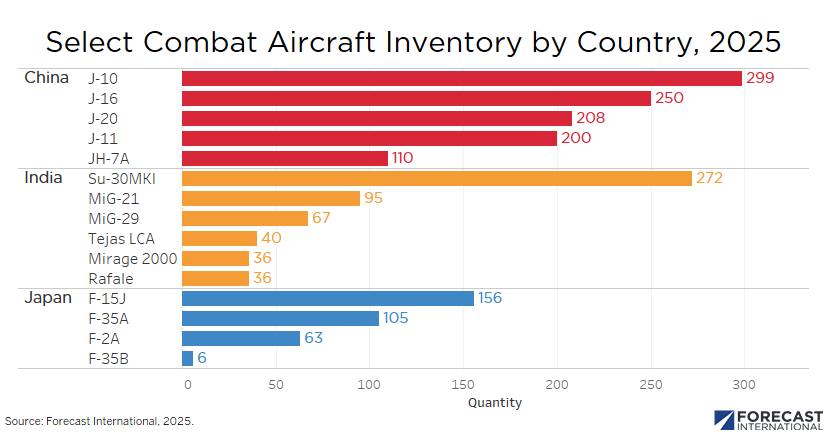

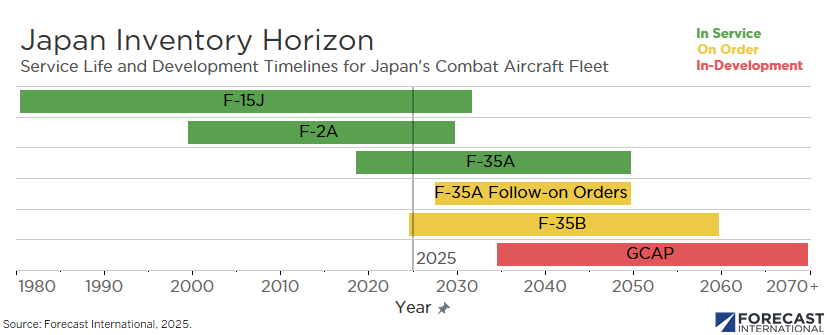

The Japan Air Self-Defense Force (JASDF) currently operates three jet fighter types: the Lockheed Martin F-35A; the Mitsubishi-built F-2; and the F-15J Eagle, which was license-produced in Japan by Mitsubishi. Altogether these three types provide the JASDF with around 260 manned combat aircraft.

Tokyo plans to increase its F-35 inventory to a total 147 fighters, made up of a mix of 105 F-35As and 42 F-35B short-takeoff-and-vertical-landing variants that will be operated off the Japan Maritime Self-Defense Force's pair of retrofitted Izumo class Multifunction Escort Ships (essentially, converted aircraft carriers). The additional F-35s will allow the JASDF to retire its legacy F-15Js.

To replace the older F-2s, Japan has embarked on a project to develop and produce a next-generation future combat air system under the trilateral Global Combat Air Program (GCAP).

The GCAP represents the merging of two separate initiatives – the British-led Anglo-Italian Tempest sixth-generation fighter initiative; and Japan's F-X next-generation project, spearheaded by Mitsubishi Heavy Industries (MHI) – in December 2022.

GCAP aims to introduce a sixth-generation manned fighter as the centerpiece of a networked advanced combat aerial system by 2035. MHI leads Japan's effort as the main systems integrator and is developing a "loyal wingman" drone to accompany the lead GCAP fighter.

Japan's involvement in the GCAP represents a significant move toward strengthening transnational defense partnerships and aerospace industrial workshare. In particular, Tokyo is expected to serve as a strong proponent to help export the GCAP platform to the Asian market and beyond.

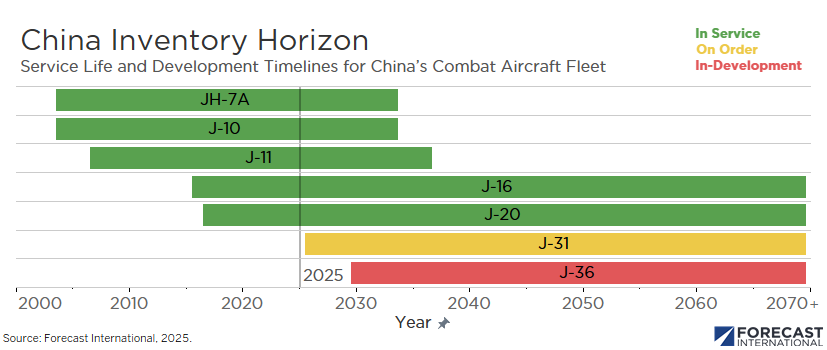

According to the Pentagon's 2024 report to Congress on China's military power, the People's Liberation Army Air Force (PLAAF) and People's Liberation Army Navy Aviation group together boast over 3,150 aircraft (not including training or unmanned aircraft), of which 2,400 are fighters, bombers, and attack aircraft. Many of these aircraft are of second- and third-generation technology, but a growing number of fourth-generation types will tilt the PLAAF into a fourth-generation majority fighter force within a short-term window (likely by 2026-2027). Within the combat aircraft segment of the overall fleet, at least 1,300 are of fourth-generation technology.

With the U.S. developing and producing the F-22 Raptor and F-35 Lightning II stealth combat aircraft and Russia its Su-57 (PAK FA, or Prospective Aviation Complex for Frontline Aviation) fifth-generation stealth fighter, China, too, aimed to be part of the club. In the late 1990s, Beijing launched its own stealth fighter program, code-named J-XX. The effort resulted in two models: the J-20 Black Eagle and J-31 Shen Fei (Falcon Eagle, also referred to as the J-21 and F-60).

One of China's chief aerospace architects, Wang Haifeng of Chengdu Aircraft Research and Design Institute, noted in February 2019 that China is determined to produce an indigenous sixth-generation jet. The jet will have the ability to command drones, feature artificial intelligence and greater stealth capability, and be equipped with "laser, adaptive engines, hypersonic weapons, and swarm warfare elements."

The goal is to bring this fighter into service by 2035.

By early 2025, indications from Chinese social media channels were that two different prototypes – one referred to as the J-XD from Shenyang, the other as the J-36 (thought to be the JH-XX) from Chengdu – were flown in late December 2024. Both have tailless stealth designs.

Also referred to as the J-50, the Shenyang J-XD appears to resemble a heavy multirole fighter. Image analysis suggests the aircraft features sixth-generation characteristics like low-observable design and potential thrust-vectoring capability. The overall wing plan and twin engines indicate a focus on long-range flight.

Additional released images of the Chengdu J-36 prototype show a much larger and heavier aircraft that could serve as a light bomber. Internal weapons bays and heavier landing gear support this theory. The J-36 also uniquely features three engines, which could yield supercruise and high-endurance flight.

In August, images of a potential third tailless fighter prototype appeared online, suggesting broader development efforts.

It remains unclear whether the multiple prototypes are part of a concerted flight-testing campaign to develop technologies or represent future sixth-generation production aircraft. Nonetheless, the aircraft confirm steady progress in China's explorative aerospace sector and underscore the country's intent to develop technologically advanced combat aircraft.

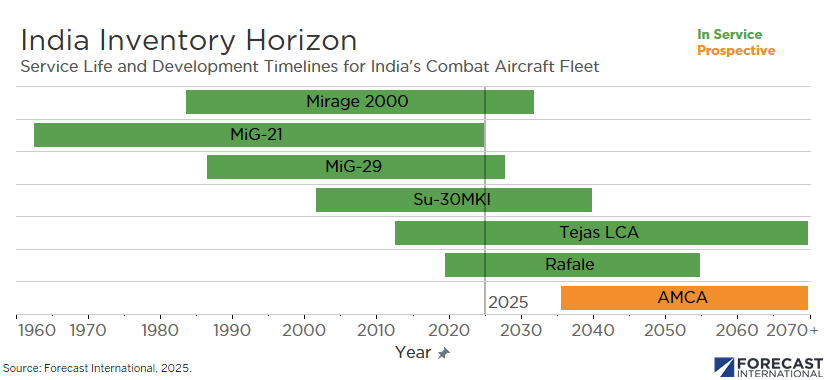

With strategic rivals perched on both India's northeastern and northwestern borders in China and Pakistan, Indian defense planners are aware of the need to maintain a formidable air- and land-based military component. As the combat potential of China's fighter fleet increases both qualitatively and quantitatively, India has been spurred to undertake the broadest and deepest modernization of the Indian Air Force (IAF) in 30 years.

The IAF's sanctioned number of combat squadrons is set at 42. But because of India's notoriously byzantine and ineffective procurement process, the official standing figure is 31 operational squadrons, with just 29 of these considered serviceable and over 25 percent of the total consisting of badly aging French-British Jaguars designed in the 1960s, as well as Soviet-designed MiG-21s and MiG-29s.

Meanwhile, by 2032, the requirement is for the IAF to field 810 fighters (including 154 fifth-generation jet fighters) in 42-45 squadrons to meet a prospective "collusive threat" two-front war with China and Pakistan.

Currently, the IAF is nowhere close to meeting its strategic goals and is instead finding itself under the microscope after shortcomings were exposed during its brief combat operations in May against Pakistan.

Despite the yawning gap between its long-term goals and current realities, the IAF's leadership remains determined to acquire more indigenous platforms to meet Prime Minister Narendra Modi's call for "Atmanirbhar Bharat," or "Self-Sufficient India," and help support and grow India's ambition for an advanced military aerospace industrial sector.

Plans now call for the service to acquire 20 squadrons (18 fighters apiece) of three domestically produced types: The Tejas (Light Combat Aircraft) Mk 1A, the Tejas Mk 2, and the Advanced Medium Combat Aircraft (AMCA).

While the initial Tejas Mk 1 variant was first brought into service in 2016 and achieved full operational capability in 2019, the program itself followed a long and winding path dating back to the 1980s, with the Mk 1A variant yet to have undertaken pre-handover operational trials despite local aerospace prime Hindustan Aeronautics Limited calling for flight-testing of the model to be completed by 2022.

The fourth-generation Tejas Light Combat Aircraft program, in other words, represents a cautionary tale for India's indigenous jet fighter ambitions.

Yet despite the extremely long horizon from project launching to design and initial production for the Tejas, Indian government officials remain determined to push ahead with a second program, this one involving the AMCA.

The AMCA was conceived in 2006 as a single-seat, multirole, twin-engine fighter that would provide the Indian Air Force with a fit between its new-generation Dassault Rafale and the Tejas light fighter. Design work began in 2009. The configurations and feasibility study wrapped up by February 2017.

The Preliminary Design Review was completed in November 2022 and the design frozen, while the Critical Design Review (begun in 2021) was concluded in December 2023.

With a design in hand, India unveiled a full-scale demonstrator model in early 2025. American-designed General Electric F414 INS-6 turbofans will power initial AMCA fighters. However, later production blocks could integrate co-produced European power plants by France's Safran or U.K.-based Rolls-Royce.

Departing from the state-run approach used with the Tejas, India plans to tap internal private companies and the public sector to compete for the AMCA. The effort aims to strengthen domestic capabilities and reduce reliance on outside suppliers.

Despite the industrial partnership approach and approval of $1.9 billion in dedicated funding for the fifth-generation program, timeline delays in previous aircraft projects will shadow ambitious plans to introduce AMCA fighters into IAF service within the next decade.

Future of Asia-Pacific Airpower

With tensions simmering in the East and South China seas and along India's borders with China and Pakistan, defense investment in the Asia-Pacific – especially in air superiority and airspace security – will remain strong. Regional militaries, wary of potential peer conflicts, aim to achieve qualitative parity if not quantitative advantage. As a result, demand remains high for combat aircraft, transport and surveillance platforms, and early warning and reconnaissance systems.

Driven in part by China's sweeping military modernization, countries within its perceived threat envelope are doubling down on quality over quantity. Australia, India, Japan, South Korea, and Taiwan are pursuing advanced aerospace capabilities through indigenous development or off-the-shelf procurement. Programs such as Japan's GCAP, India's Tejas and AMCA, South Korea's KF-21 Boramae, and Taiwan's T-5 Brave Eagle reflect this dual objective: meeting defense needs while advancing domestic aerospace industries.

At the same time, rising costs and risks – particularly the potential loss of elite pilots during missions in contested airspace – are pushing countries to invest in uncrewed aerial systems (UAS). These range from expendable one-way drones to high-end reusable platforms capable of operating autonomously or alongside manned fighters.

Japan is already phasing out crewed assets like the AH-1, AH-64, and OH-1 helicopters in favor of UAS, expanding their role in maritime surveillance and beyond. Australia is developing its own unmanned combat aerial vehicle program to bolster the Royal Australian Air Force's combat capabilities – whether integrated with manned aircraft or operating independently.

As anti-access/area-denial environments grow more sophisticated, expect more countries to pivot toward unmanned solutions that offer reduced costs and lower operational risks compared with traditional crewed platforms.

This content is made possible by our sponsor General Atomics Aeronautical Systems; it is not written by and does not necessarily reflect the views of Defense One editorial staff.

NEXT STORY: Golden Dome: Smart Buyer Strategies