sponsor content What's this?

Defense Industrial Ecosystems of the Middle East

Presented by

Forecast International

Countries in the Middle East are major importers of military systems, relying on suppliers from the United States, Europe, Russia, and increasingly China to provide the advanced equipment that underpins their conventional warfighting capabilities. These defense relationships also offer political leverage, helping the region’s capitals navigate the Middle East’s complex and often volatile geopolitics.

Dependence on arms imports, however, can be a double-edged sword, potentially exposing importers to supply disruptions should its foreign partners become unable or unwilling to continue selling equipment. Vast sums of money must be devoted towards procurement, and in a pure ‘off-the-shelf’ transaction most of that money will go abroad. Governments in the Middle East have thus taken on an interest in defense industrialization, hoping to lessen their foreign dependence and diversify their economies while continuing to safeguard their security.

Israel: Regional Defense Industrial Leader

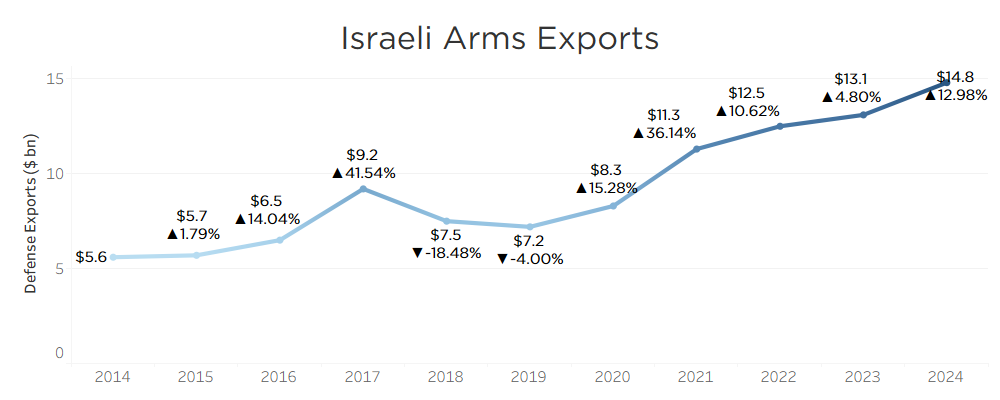

Israel’s defense industry stands apart from its peers in the region, both in its maturity and technological sophistication. The Israeli government has emphasized the importance of a strong defense industry for decades, viewing it as one component to maintaining an edge over its rivals in the Middle East. Israeli defense companies have thus blossomed over the years, and the country has become one of the largest defense exporters in the world, selling a record $14.8 billion in military hardware in 2024.

Emphasis on integrating innovative technologies into its military equipment has enabled the Israeli defense industry to become one of the world’s most advanced, driving up exports.

Long known as an oil export powerhouse, Saudi Arabia announced a major economic initiative in 2016, dubbed Vision 2030, that aims to transform the Saudi economy and reduce its dependency on energy income.

Among the projects announced under the Vision 2030 banner is an overhaul of the defense sector, with a target of reaching 50 percent localization by the end of 2020s. That would be no small objective for any arms importer to pursue, but especially for Riyadh, given the size of its military procurement and the modest starting point for its industry – as of 2018, only around four percent of the Kingdom’s arms purchases were being sourced domestically. This is despite the Kingdom being the Middle East’s largest defense spender, devoting some 20 percent of government expenditure to the sector.

Under Vision 2030, Saudi Arabia wants to accelerate the creation of joint ventures and license-assembly deals to link up with the foreign companies that have traditionally acted as suppliers to the Kingdom. Some effort had already been made to do just that, with Alsalam Aerospace’s production of F-15 wingsets, begun in 2013, serving as a shining example, and the Saudi government has sought to double-down on those initiatives while streamlining the organization of its defense industry.

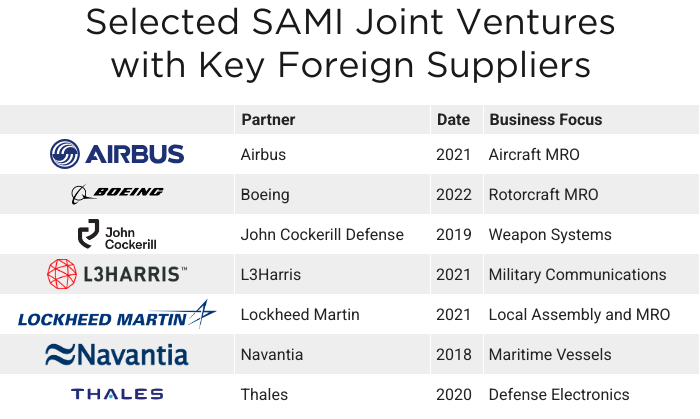

In 2017, Saudi Arabia’s government-run Public Investment Fund established a single state-owned conglomerate, Saudi Arabian Military Industries (SAMI), to integrate the country’s defense ecosystem. The Kingdom also created the General Authority for Military Industries (GAMI) that year to oversee access to its industry and coordinate research and development (R&D) projects.

Since its creation, SAMI has led the charge in creating new tie-ups with foreign suppliers, inking a number of partnership agreements with top defense suppliers in the U.S. and Europe to localize production, build-out maintenance, repair, and overhaul (MRO) capabilities, and explore new technologies such as autonomous systems.

Private companies have begun emerging in Saudi Arabia as well, focusing on particular segments such as drone production. In 2022, the Saudi company Intra Defense Technologies began manufacturing the Haboob UAV, a local version of Turkey’s Vestel Karayel-SU drone, as part of a co-production deal with SAMI’s Advanced Electronics Company.

At least in the near term, the Saudi industry is not necessarily aiming to be an originator of new platforms, focusing instead on integration into the supply chains that deliver foreign-made military equipment to the Saudi force structure. The idea is that a steady stream of defense acquisitions should spur downstream offset partnerships that drive manufacturing growth in Saudi Arabia. Arms imports thus become a vehicle for localization, meaning Saudi Arabia can be expected to remain a key importer of defense equipment in the Middle East. As the Saudi industry develops, those systems will have more and more Saudi content in them, or at least be assembled in-country.

Saudi Arabia has ambition to become a defense innovator over the long term. GAMI governor Ahmed bin Abdulaziz al-Ohali laid out a plan to invest around $20 billion in the Saudi defense industry through 2031, noting that around half of that figure would be reserved for R&D. GAMI ultimately hopes to bring R&D spending to four percent of the Kingdom’s defense budget by 2030, which would equate to an annual floor of around $3 billion compared to the $78 billion defense budget approved for this year.

The United Arab Emirates, like Saudi Arabia, views defense industrialization as one avenue through which to diversify its economy. In 2019, two years after Saudi Arabia established SAMI, the UAE followed suit with the creation of EDGE Group, integrating dozens of state holdings into a single defense conglomerate that covers the bulk of the Emirati defense industry.

But whereas much of the order book for Saudi Arabia’s defense industrialization process is driven by the state’s own massive procurement needs, the UAE has looked outward to the export market as a way to nurture its industry. As of December 2024, EDGE Group companies had a backlog of contracts worth $12.8 billion, at least a third of which were for foreign sales. The company’s CEO, Hamad al-Marar, said around that time that EDGE wants exports to account for around 40 percent of sales.

The Falaj-3 missile boat program serves as an example of a successful Emirati localization program that is now beginning to pay dividends in exports. In May 2021, the Emirati Ministry of Defense awarded a contract to Abu Dhabi Ship Building (ADSB), part of EDGE Group, to supply four Falaj-3 boats to the Emirati Navy. ADSB partnered with ST Engineering on the project, which utilizes the Singaporean company’s Fearless class as the basis for the design.

Moving forward, EDGE Group is looking to sell the Falaj-3 to other customers in the region, reaching a landmark deal worth about $2.5 billion to sell the type to the Kuwaiti Ministry of Defense in June 2025. Under that deal, ADSB will produce eight missile boats for the Kuwaiti Navy.

There are parallels between the development of the UAE’s industry and the path that Israel’s industry has taken, and warming ties between the two has enabled some partnership in the defense space to emerge. In November 2021, EDGE Group announced a strategic agreement with IAI on the creation of a modular unmanned surface vessel. Earlier in 2025, an Israeli military company named Thirdeye Systems sold a stake to EDGE and the two plan to collaborate on a joint venture.

Developing ties with the Israeli industry is seen in the UAE as a boost for EDGE, particularly in the UAV segment. In the 2010s, the UAE found some export success selling domestically-designed drones to Algeria and Nigeria, demonstrating that the UAE could establish itself in the competitive drone market. Collaborating with Israel could enable the UAE to offer even more advanced systems in the future. Over the summer of 2025, reports emerged that the UAE will procure the Elbit-made Hermes 900 under a deal that could see EDGE receive technology transfer.

Foreign partnerships enable the UAE to localize production and develop a domestic ecosystem capable of fostering innovation. In time, the goal is to make the UAE both a destination for and originator of advanced defense technologies.

This content is made possible by our sponsor General Atomics Aeronautical Systems; it is not written by and does not necessarily reflect the views of Defense One editorial staff.

NEXT STORY: Turning data overload into mission advantage